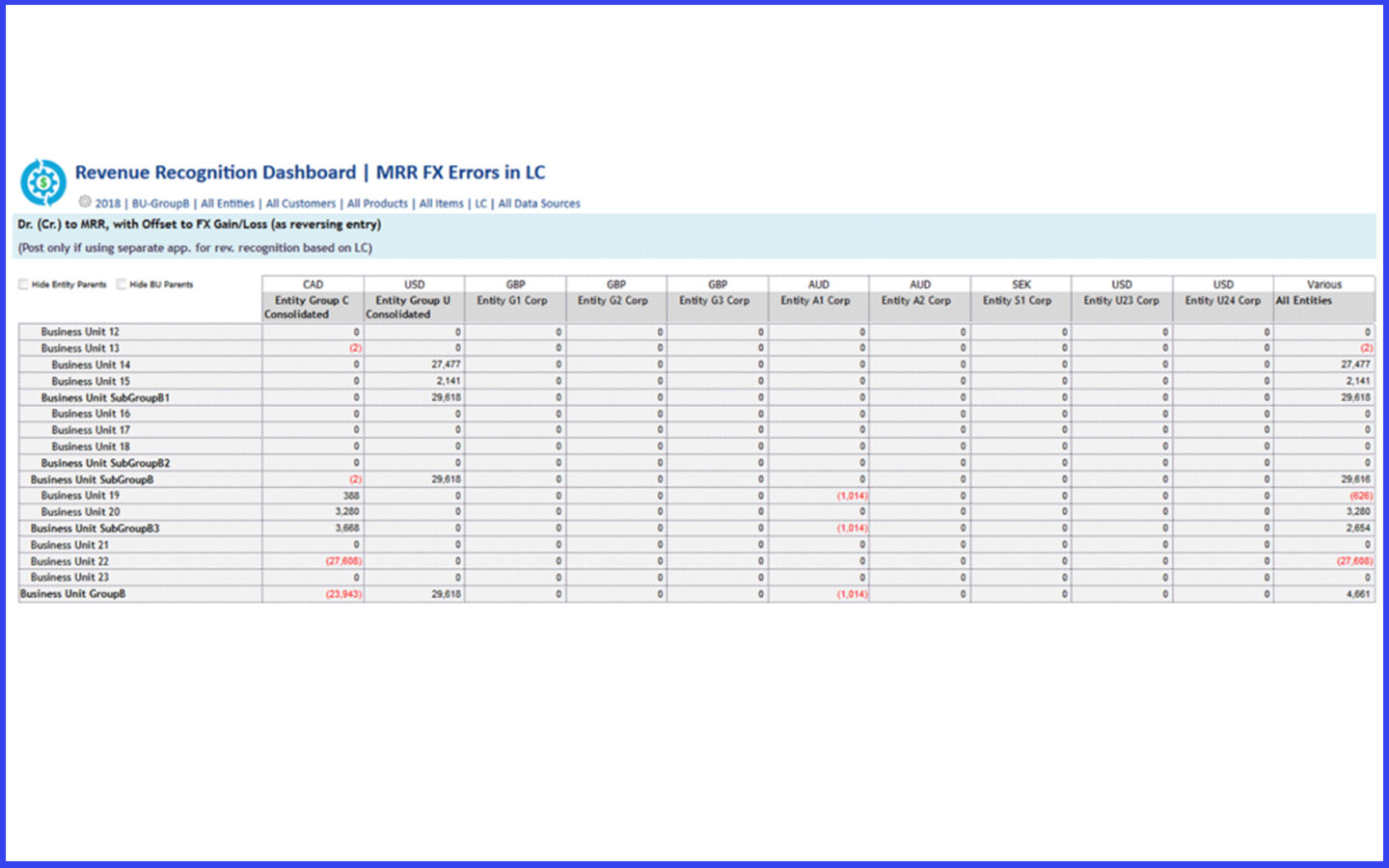

With MRR Churn’s built in revenue recognition engine, calculation and tracking of deferred revenue and related GL accounts can be done at the most extreme level of granularity: down to the invoice line item level. Even if the same exact product is billed multiple times on the same invoice covering different recognition periods, each line item will be tracked and recognized separately. This also means every GL recognition and FX account will also be tracked at the invoice line item level.